A Comprehensive Guide to Credit Cards for Malaysians

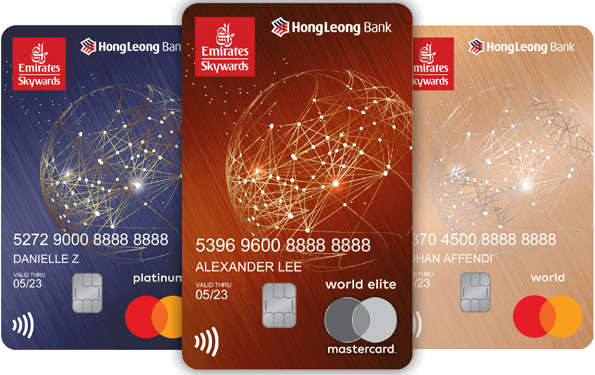

When it comes to managing your finances, having the right credit card can make all the difference. Hong Leong Bank (HLB) is a leading financial institution in Malaysia, offering a range of credit cards that cater to the diverse needs of Malaysians. In this article, we will delve into the world of HLB credit cards, highlighting their benefits and features, helping you choose the perfect card to suit your lifestyle.

Understanding HLB Credit Cards

HLB credit cards provide Malaysians with a convenient and secure way to make payments, both locally and internationally. With a wide array of card options, HLB caters to different preferences, offering benefits such as reward points, cashback, travel privileges, and exclusive promotions.

Benefits of HLB Credit Cards

- Reward Points and Cashback: HLB credit card offers reward programs that allow you to earn points for every transaction. These points can be redeemed for a variety of options, including shopping vouchers, air miles, and cash rebates. Some cards also offer cashback on specific categories such as dining, groceries, and petrol, enabling you to save while you spend.

- Travel Privileges: For frequent travellers, HLB credit card comes with enticing travel perks. These include complimentary airport lounge access, travel insurance coverage, and discounts on hotel bookings and airfare. By using your HLB credit card for travel-related expenses, you can enjoy exclusive benefits and enhance your overall travel experience.

- Lifestyle Privileges: HLB credit cards also offer a range of lifestyle benefits. From discounts at partner merchants to exclusive access to events and entertainment, HLB ensures that its cardholders enjoy a host of privileges and experiences tailored to their interests.

Choosing the Right HLB Credit Card

To select the ideal HLB credit cards for your needs, consider the following factors:

- Spending Habits: Analyse your spending patterns and choose a credit card that offers rewards and cashback on the categories you frequently spend on, such as dining, shopping, or travel.

- Interest Rates and Fees: Compare the interest rates and fees associated with different HLB credit cards. Look for cards with low or zero annual fees and competitive interest rates to maximise your savings.

- Credit Limit: Determine the credit limit that suits your financial needs. It is advisable to choose a credit card with a limit that aligns with your income and spending capacity.

Conclusion

Hong Leong Bank (HLB) credit cards provide Malaysians with an array of benefits and features that enhance their financial experience. Whether you’re looking for reward points, cashback, travel privileges, or lifestyle benefits, HLB has a credit card option to suit your needs. By choosing the right HLB credit card, you can enjoy exclusive privileges, save money, and make your financial transactions more convenient. Take the time to explore the various HLB credit cards available, compare their features, and select the card that aligns with your lifestyle and preferences. With HLB by your side, you can embark on a rewarding and fulfilling financial journey.